What is underinsurance?

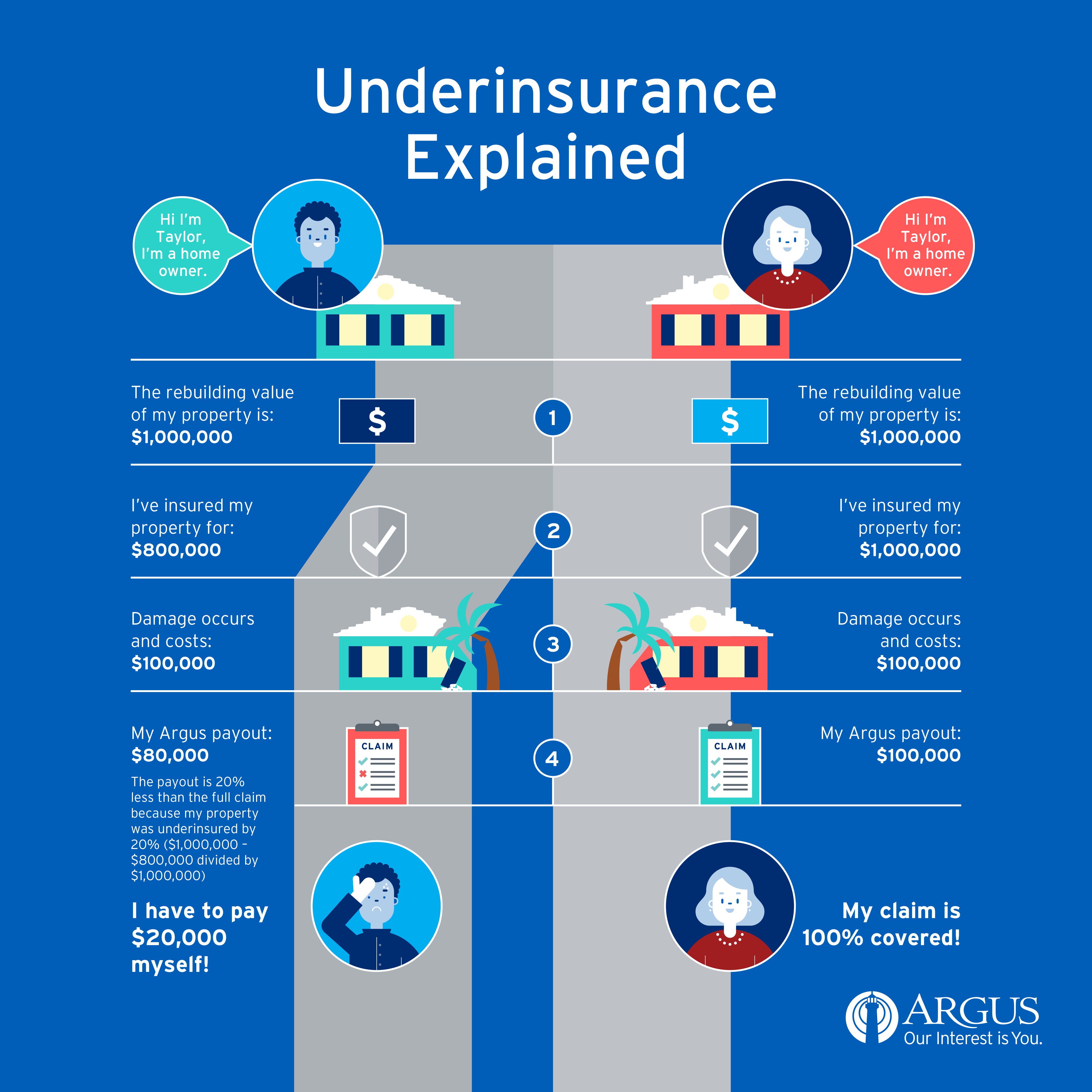

Underinsurance occurs when the value of your home insurance policy isn't enough to cover the full cost of rebuilding, repairing or replacing your home. Learn more about the importance of home insurance here.

How does underinsurance affect you?

To be underinsured is just like it sounds: in the event of a claim, you may discover your policy does not cover the full value of your property.

Often people try not to insure their home for its full value in an attempt to save money on their premium. These attempts at saving can actually cause serious financial consequences if you have to cover a portion of the losses yourself.

Below is an illustration of what can happen if your home is underinsured.

Here are some tips to help you avoid underinsurance

- Obtain a building evaluation every 3 to 5 years.

- Adjust your sums insured after purchasing a valuable item or completing a renovation.

- Ensure high value items are insured for the right amount - obtain a valuation.

- Check your policy to understand what your cover includes/excludes.

- Avoid the cheapest policy or minimum cover! If your home is your biggest asset make sure it is protected by an appropriate insurance policy.

- Never underestimate the real value of your household contents. If you suffer a major loss you'd be surprised at how much it costs to replace all your belongings.

- Don't be afraid to contact our customer service team on 298-0888 or at insurance@argus.bm. We are here to help you make the right decision to insure and protect your assets.

Sign In

Sign In